how much does it cost to hire a tax attorney

Every attorney will charge a different hourly rate but most rates are between. Get Your Free Tax Analysis.

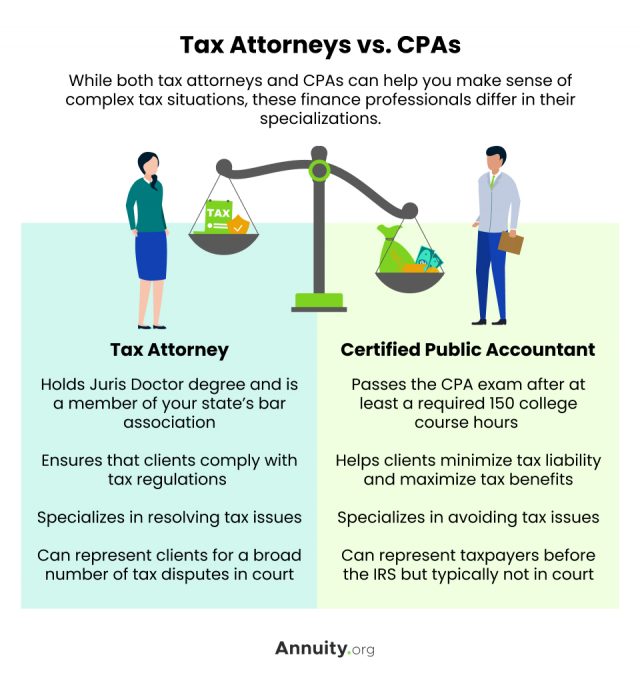

Cpa Vs Tax Attorney Top 10 Differences With Infographics

As of November 2021 The Law Office of Jin Kim charges 350 per hour.

. Find Out Now For Free. Nov 6 2019 On average a tax attorney costs about 300 per hour with average tax lawyer fees ranging from 200 to 400 in the US for 2019. However most tax resolution cases are accepted on a flat fee basis rather than an hourly rate.

Types of Tax Attorney Fees. A lawyer often charges between 100 and 400 per hour for their. In general you can expect to pay anywhere from 100 to.

Dont Go At It Alone. Tax attorneys generally charge either an hourly rate or a flat fee for their services. Ad Find 100s of Local Tax Accountants.

Analysis Comes With No Obligation. Ad Search For Info About How much does a tax attorney cost. To hire a Tax Attorney to complete your project you are likely to spend between 150 and 450 total.

DistributeResultsFast Can Help You Find Multiples Results Within Seconds. Get Your Free Tax Analysis. Some tax attorneys charge a flat hourly rate with the large firms charging well in excess of 600 per hour.

If you opt to hire the best tax lawyer in your area you might even spend 1000 per hour. The average cost of hiring a certified public accountant CPA to prepare and submit a Form 1040 and state return with no itemized. Whatever You Need Find it on Bark.

Ad Trusted A BBB Member. Although each tax attorney will charge their own hourly rate you can expect to pay anywhere between 200 and 400 per hour. What does contingency basis meancontingencycontract attorney hires In Pain.

Tax attorneys usually get paid in one of two ways. However costs can reach as high as 450. Trusted Reliable Experts.

Ad Get Your Own Business Attorney On-Call and Get Real Legal Work Done at a Discount. The majority of tax attorneys charge by the hour. The Cost of Hiring a Tax Attorney Just like a doctor charges you differently for different illnesses similarly there typically is no set fixed fee for a tax attorney.

Analysis Comes With No Obligation. Find Out Now For Free. Other tax attorneys charge a.

Browse Get Results Instantly. For many other sorts of cases particularly tax issues an hourly fee is a typical approach to charge. For simple cases that require only a modest amount of legal representation you can pay.

Every attorney will charge a. The typical cost for a bankruptcy attorney can range from 100 to 400 an hour. This is so you can receive some consultation on what they can do for you and see if the attorney is the right fit.

Types of Tax Attorney Fees. How much does a tax accountant cost. The majority of tax attorneys charge by the hour.

However most tax lawyers charge an hourly rate ranging between 200 to 400. Heres a quick breakdown of the average prices tax attorneys charge for common tax services hourly or flat fee. But hourly billing may not come into play with Chapter 7 and Chapter 13 bankruptcies.

To negotiate small agreements with the IRS you can pay from 700 to 1500. Ad Top-rated pros for any project. How Much Does it Cost to Hire a Tax Attorney.

The cost of working. The average cost for a Tax Attorney is 250. The first question that comes to the minds of those who are considering hiring a tax lawyer is how much its going to cost them.

On average a Brotman Law tax audit representation costs between 3500 and 10000 per tax year for most audit defenses against the IRS. Ad Trusted A BBB Member. How Much Does a Tax Lawyer Cost.

The cost of hiring a tax attorney can vary depending on a number of factors including the attorneys experience and location. Trusted Reliable Experts. In fact a majority of individuals shy away from contacting.

A common question we get is how much does it cost to hire your firm. Jun 22 2021 An hourly rate is a. While the price may seem like a big spread.

Cpa Vs Tax Attorney What S The Difference

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

Cpa Vs Tax Attorney Top 10 Differences With Infographics

When An Llc Actually Needs An Accountant A Simple Checklist By Matt Jensen Taxes Taxeseason Taxesdone Taxesm Small Business Tax Business Tax Llc Business

Tax Attorney When To Get One And What To Look For

Safeguard Your Intellectual Property Before It S Too Late Our Qualified Attorneys Are Here To Follow Up Yo Family Law Attorney Business Law Litigation Lawyer

Top 5 Income Tax Lawyers In India And One Landmark Case They Argued

How Much Does A Tax Attorney Cost Cross Law Group

Do I Need A Tax Accountant Experian

Tax Attorney Vs Cpa What S The Difference Turbotax Tax Tips Videos

2022 Average Cost Of Tax Attorney Fees Get Help Today Thervo

7 Questions To Ask When You Re Vetting A Tax Lawyer Legalzoom

How To Become A Tax Attorney Jobhero

Why Tax Lawyers Are The Richest Lawyers

This Terrorised The Blades Then The Injurytruck Trucks Large Truck Accident

Everything You Need To Know About A Tax Attorney Turbotax Tax Tips Videos

How Much Does A Tax Attorney Cost Cross Law Group

Things Your Tax Accountant Won T Tell You For Free Reader S Digest